Introduction:

In the age of digital revolution, carrying cash is becoming increasingly obsolete. Enter contactless payments, a revolutionary technology that has transformed the way we pay for goods and services. From swiping cards to tapping smartphones, the evolution of contactless payments has been remarkable, offering a seamless and secure experience for both consumers and merchants.

The Rise of Contactless Payments:

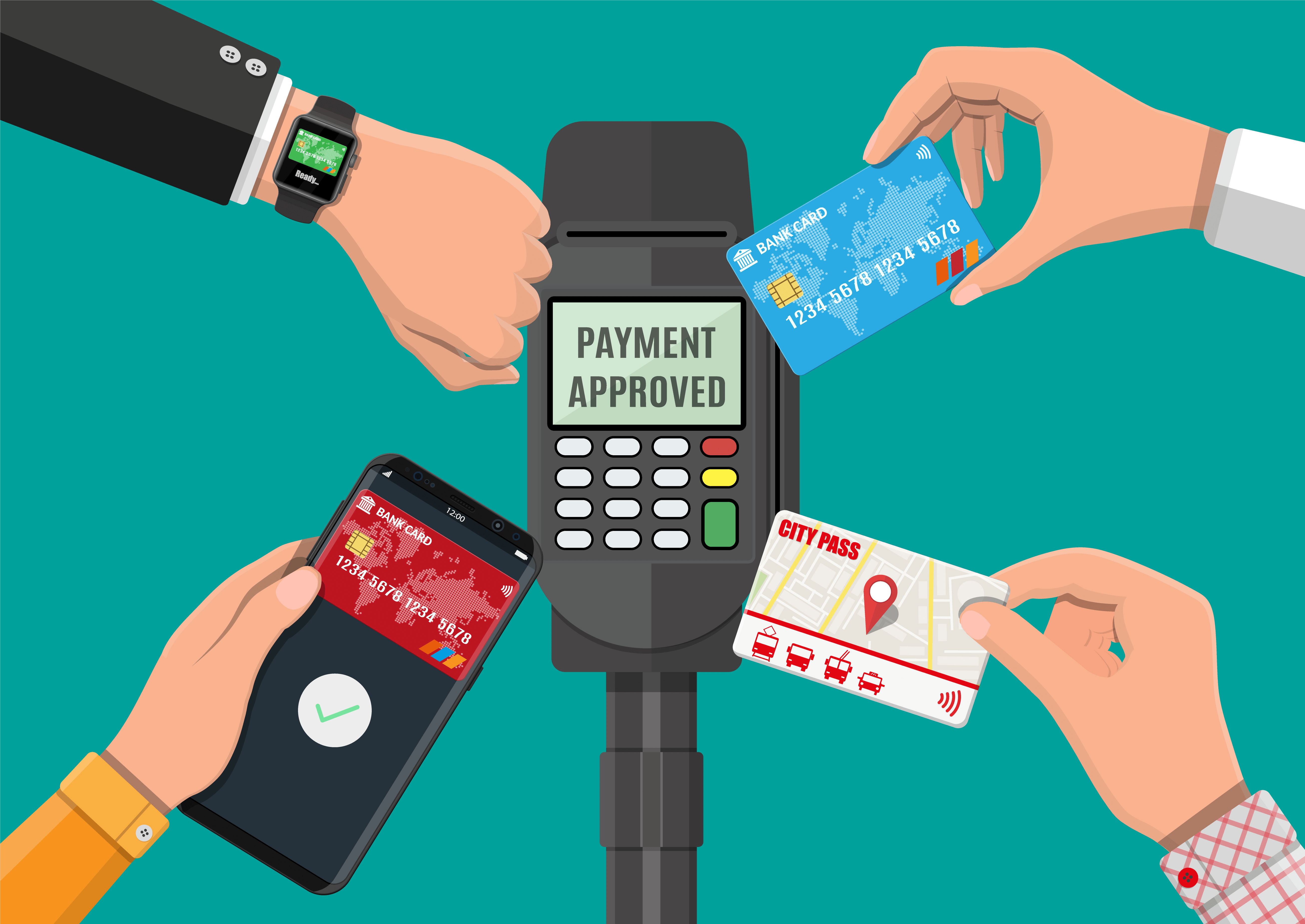

The journey of contactless payments started in 1995 with the launch of the UPass in Seoul, a smart card used for public transportation. Since then, the technology has evolved rapidly, driven by advancements in Near Field Communication (NFC) technology. Today, contactless payments are widely accepted across the globe, with various options like:

- Contactless cards: These cards contain an embedded chip that communicates with NFC-enabled terminals via radio waves. Simply tap the card on the reader, and your payment is processed instantly.

- Mobile wallets: Leading smartphone brands like Apple, Samsung, and Google offer mobile wallets like Apple Pay, Samsung Pay, and Google Pay. These wallets securely store your credit card information and allow you to make contactless payments with your phone.

- Wearable devices: Smartwatches and fitness trackers equipped with NFC technology are also becoming popular contactless payment options.

Benefits of Contactless Payments:

There are numerous advantages to using contactless payments:

- Convenience: No need to fumble for cash or your wallet. Simply tap and go!

- Speed: Transactions are processed instantly, making checkout faster than ever before.

- Security: Contactless payments offer enhanced security compared to traditional cards. Your information is encrypted and transmitted securely, reducing the risk of fraud.

- Hygiene: Eliminates the need to touch shared surfaces like keypads, which is particularly beneficial in a post-pandemic world.

- Rewards: Many contactless cards and mobile wallets offer rewards programs, allowing you to earn points or cashback on your purchases.

Best Credit Cards for Contactless Payments:

The best credit card for contactless payments depends on your individual needs and spending habits. Here are some top picks:

1. Chase Sapphire Preferred: This card offers a generous sign-up bonus, excellent travel rewards, and a wide range of travel insurance benefits. It also features contactless technology for seamless payments.

2. Capital One Venture Rewards: This card is another great choice for frequent travelers. It offers a flexible rewards program that allows you to redeem points for travel, statement credits, or gift cards. Additionally, it features contactless technology for convenient payments.

3. American Express Blue Cash Everyday: This card offers a 3% cash back on groceries and gas, making it ideal for everyday spending. It also features contactless technology for quick and easy payments.

4. Apple Card: This card seamlessly integrates with Apple Pay, offering a smooth contactless payment experience. It also boasts a sleek design and generous rewards program.

5. Google Card: This card offers a simple cashback program with no annual fee. It also integrates seamlessly with Google Pay and features contactless technology for convenient payments.

Future of Contactless Payments:

The future of contactless payments is bright, with exciting innovations on the horizon. Here are some trends to keep an eye on:

- Biometric authentication: Fingerprint and facial recognition technology could replace traditional PIN codes for added security.

- Peer-to-peer payments: Contactless technology could revolutionize how we send and receive money from friends and family.

- Internet of Things (IoT) payments: Imagine paying for your groceries simply by walking out of the store with your smart shopping cart. This is just one example of how contactless technology could be integrated into everyday objects.

Conclusion:

Contactless payments are revolutionizing the way we pay for goods and services. With its convenience, speed, security, and hygiene benefits, it’s no surprise that this technology is becoming increasingly popular. As contactless payments continue to evolve, it’s exciting to imagine the possibilities for a truly cashless future.